Download Black by ClearTax App to file returns from your mobile phone. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Clear can also help you in getting your business registered for Goods & Services Tax Law. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

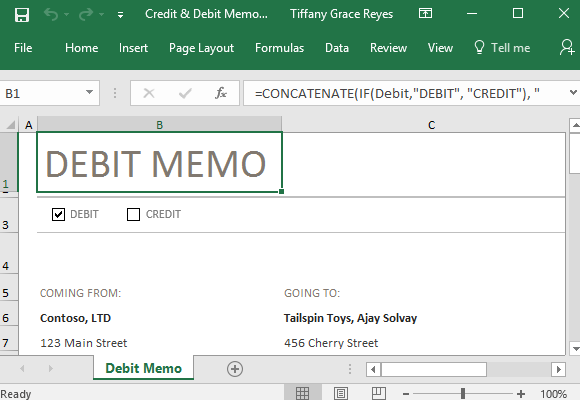

DEBIT MEMO SOFTWARE

Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.ĬAs, experts and businesses can get GST ready with Clear GST software & certification course. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Just upload your form 16, claim your deductions and get your acknowledgment number online. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.Įfiling Income Tax Returns(ITR) is made easy with Clear platform. The buyer issues a credit note as an acknowledgement of a debit note received.Ĭlear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. The seller issues debit notes to the buyer if the buyer is undercharged or the seller has sent additional goods. It leads to updating of sales return books.Ī debit note is issued in exchange for a credit note.Ī credit note is issued in exchange for a debit note. It leads to updating purchase return books. It reduces account payables in the books of the buyer.Ī credit note reflects a negative amount. It reduces account receivables in the books of sellers. Instead of a traditional transaction, an adjustment is notified to you via a debit memo. It can be issued only in the event of credit sales. A debit memo, alternatively known as a debit memorandum, is a notice that clients receive when their account balance has decreased and needs to be rectified. It can be issued only in the event of credit purchases from the buyer's perspective. The seller of goods issues a credit note to confirm that the purchase return is accepted. A debit note contains the reason for the return of goods. The buyer of goods issues a debit note to the seller to return the goods received due to quality issues or other reasons. But the following comparison is made in common business parlance.īelow is a comparative table of debit notes vs credit notes: Particulars

The understanding of terms could also vary from the perspective of the seller and buyer. These notes inform the buyer how much credit they have or how much further they owe to the vendor.ĭebit note vs credit note becomes important to understand where business frequently deals with both scenarios. Businesses use debit notes and credit notes as official documents for accounting sale return and purchase return transactions.

0 kommentar(er)

0 kommentar(er)